ACCOUNTING & TAX

Payroll / Personal income tax reporting

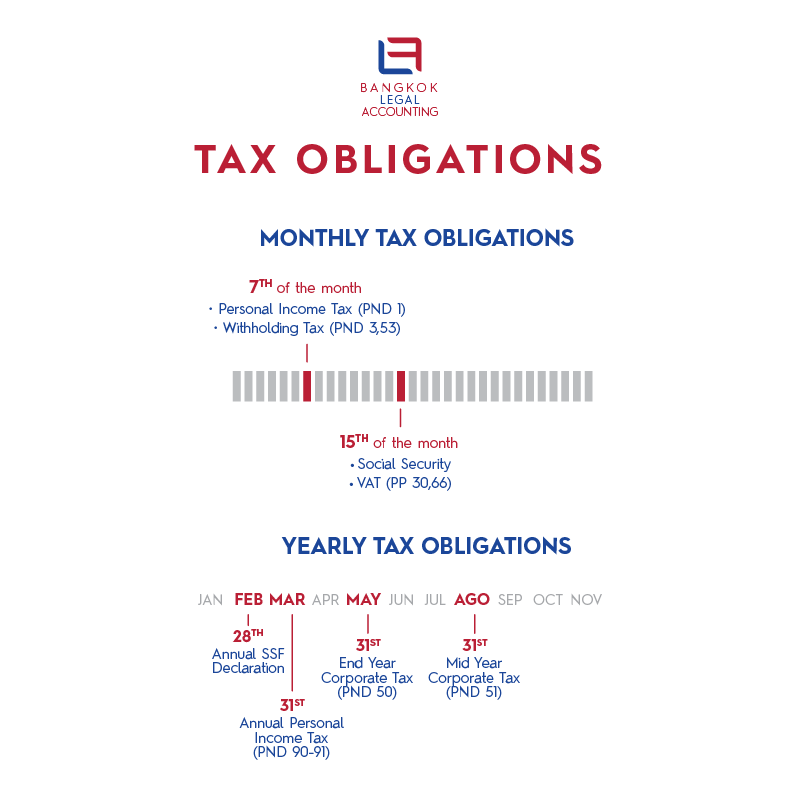

A monthly payroll report for all of your employees, including yourself.

VAT reporting and filing

VAT report on all sales and business transactions, due by the 15th of each month for the preceding month.

Withholding tax reporting and filing

A monthly report and remittance covering a Withholding tax collected through a deduction made on a payment when the payment is made. The payer will report and remit the Withholding Tax to the Revenue Department on a monthly basis.

Monthly social security payments

A mandatory report and remittance, for each of your employees.

Regular monthly bookkeeping

Electronic account entry with Profit & Loss and Balance sheet. A/R, A/P, GL.

Accounts Receivable Management

We take care of your customers billing, outstanding payments follow-up and collection.

Accounts Payable Management

We become the direct point of contact with your vendors, collecting and paying your bills.

Annual Audit

Assistance in providing the required audit trail to a third party audit firm for the preparation of the required financial reports, and the filing of the annual audit report with the Commercial Registration Department, Ministry of Commerce, Revenue Department and Ministry of Finance.

Note: This does not include the actual audit process.